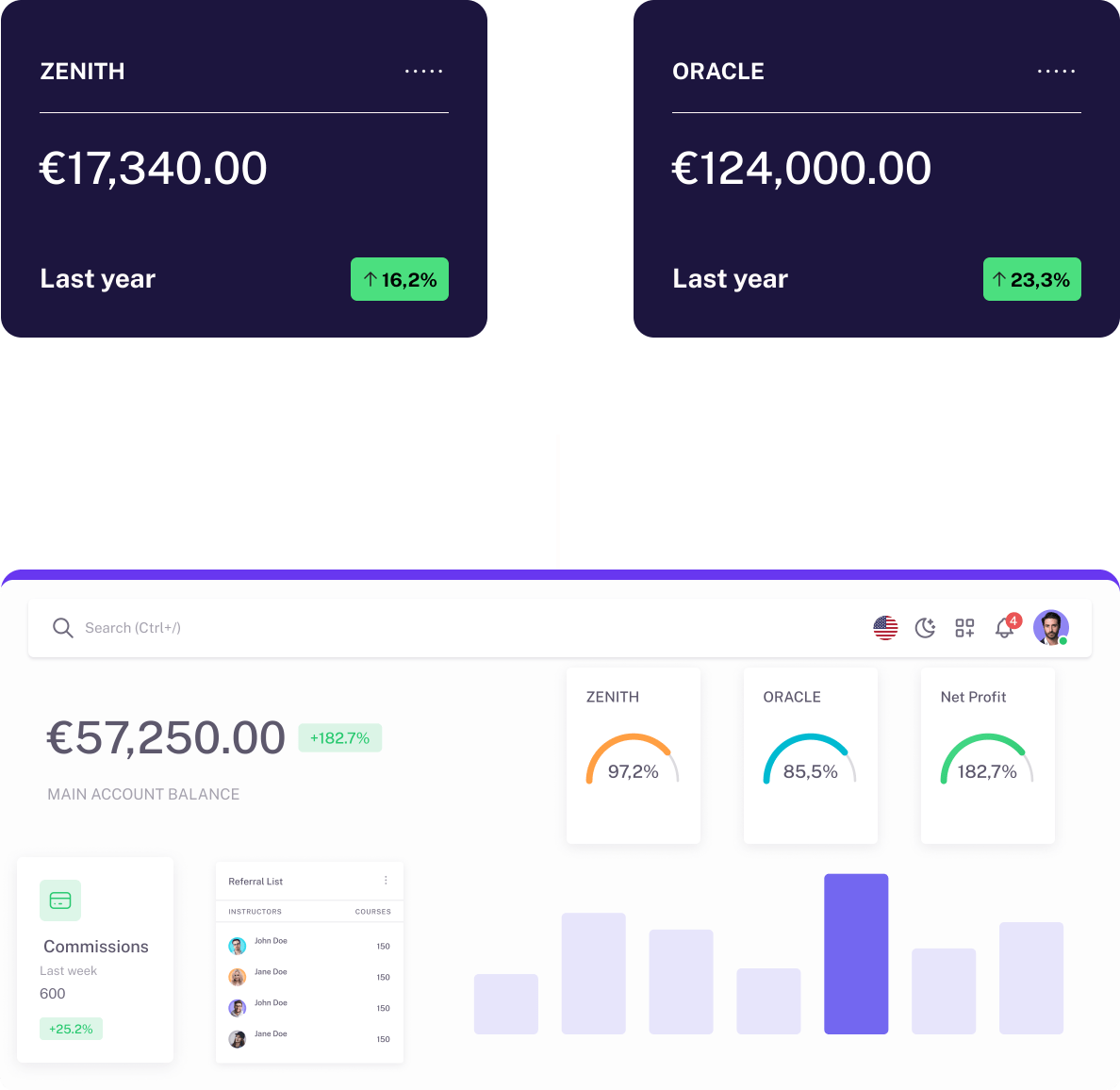

P7 Zenith

The Zenith Plan is P7’s answer to those seeking a steadfast approach to investment over a three-year horizon. It stands as a beacon of calculated financial progression, striking an optimal balance between enduring security and assured growth. This plan is crafted for discerning investors who aim to cultivate their financial landscape with confidence, backed by the guarantee of a structured, robust investment journey.

Mission

The Zenith Plan is conceived to elevate the investment experience by guaranteeing a robust annual growth that aims to consistently exceed standard financial benchmarks. This strategy is designed to empower investors with a steadfast, medium-term growth trajectory, circumventing the pitfalls of volatile markets and the often negligible growth rates offered by traditional financial institutions. With Zenith, the commitment is towards a more enlightened and secure financial future, free of undisclosed charges.

At the heart of ZENITH lies a commitment to robust, asset-backed, and progressive investing strategies. This three-year plan, with its adjustable interest rates through various bonuses and a sophisticated yet accessible framework, represents a prime choice for those seeking a balance between security and enhanced profitability. ZENITH is designed not just as an investment plan but as a journey towards greater financial growth and stability.

Solution

The ZENITH Plan strategically channels investments into the expansion of our successful business operations with established profitability. This focus creates a stable and secure investment environment, insulated from the volatility typical of new startups.

A testament to transparency and consistency, the plan guarantees a fixed interest rate, reinforcing the promise of steady returns. It offers investors the autonomy to tailor their investment journey — whether by extending the investment term for compounded benefits or opting to reinvest the interest for enhanced financial outcomes.

With P7’s Plans, your investment effectively serves as a loan to our established and profitable business portfolio, ensuring stable and predictable returns.

This method offers secure, bond-like advantages with a promise of fixed earnings.

We stand firm in our commitment to deliver these returns, providing you with peace of mind and a definitive expectation of your investment’s financial benefits.

The Zenith plan stands out by allocating funds exclusively to the expansion of established, profitable businesses.

By avoiding the inherent risks of new ventures, your investment is shored up by enterprises with a history of success and fiscal responsibility.

This targeted approach ensures that your funds are not only backed by tangible assets but are also reinvested into operations with a track record of profitable growth, offering a stronger safeguard for your investment

Asset Safeguard: Investments in the Zenith plan are backed by a robust portfolio of EU-based tangible assets, offering an additional layer of financial security.

Strategic Diversification: The plan’s assets are strategically diversified within stable and profitable EU sectors, enhancing resilience against unforeseen global events.

Investor Assurance: In extreme scenarios, the plan is structured to prioritize investor capital preservation, with the option to liquidate or allocate equivalent assets to investors, ensuring capital is not forfeited.

Zenith‘s investment strategy leverages a diverse array of tangible assets across multiple resilient sectors, ensuring strong collateral support for your investment. Each sector is carefully selected for its enduring value and growth potential:

- Hospitality and Leisure: Investments are anchored in properties and businesses that cater to travel and leisure, an industry known for its enduring appeal and capacity for growth.

- Photographic Equipment Production: This sector includes tangible assets in the form of high-quality photographic equipment, ensuring a solid base in a market with a consistent demand.

- Health and Nutrition: Investments in this sector focus on products and services in health and wellness, an area with a steadfast consumer base and growing global awareness.

- Talent Management: Investment in this sector involves backing human talent and creativity, particularly in models and actors, providing a unique asset base with potential for high returns.

- Film and Entertainment Production: Investments here are tied to tangible assets in the entertainment industry, such as production equipment and rights, offering a blend of stability and creativity.

Turn your network into your net worth.

When you introduce a new investor to the Zenith plan, each of you will benefit from a €150 bonus, enhancing your investment journey

The bonus is immediately available to the new investor, while you, as the referrer, will see your reward once their investment is active

This reciprocal incentive fosters a community of growth, where sharing the opportunity expands rewards for all involved.

By reinvesting your initial capital and the interest gained at each cycle, you unlock an additional 0.9% increase in your interest rate with every reinvestment.

This bonus can be utilized up to three times with each reinvestment cycle, thereby progressively growing your investment.

An upfront commitment to a minimum of two consecutive terms unlocks a 1% Commitment Bonus, further boosting your rate

The Zenith Plan’s structure is fully securitization-eligible.

Asset-backed loan positions can be pooled and transformed into tradable securities, enabling professional investors to create customized ABS or CDOs for enhanced portfolio flexibility.

This mechanism increases liquidity, reduces risk concentration, and supports strategic capital deployment across multiple asset classes. The result: institutional-level control over asset cycling, yield optimization, and exit timing—without compromising on underlying collateral integrity.

Step into a world of investment where transparency reigns supreme.

With Zenith, you’re assured of a fee structure that’s straightforward—no management fees, no processing fees, and absolutely no hidden costs.

Our commitment to transparent financial commitments ensures that your investment experience is crystal clear, with no unexpected charges.