P7 Pulse

The P7 Pulse Plan—a meticulously engineered one-year investment opportunity designed to not just match, but outperform, the average inflation rate. Unlike traditional banks that offer less-than-satisfactory returns and charge hidden fees, Pulse Plan is transparent, secure, and tailored for real wealth growth

Mission

The PULSE plan is engineered to revolutionize traditional investment methods by offering guaranteed returns that exceed average inflation rates. This strategy aims to democratize investing and sets it apart from conventional banking systems known for their below-inflation yields and hidden fees.

At the core of PULSE is a transparent, asset-backed, and growth-oriented strategy. With fixed interest rates and a user-friendly structure, this one-year investment plan serves as an excellent introduction to secure and profitable investing

Investments Reinvented

Solution

The PULSE plan takes a two-pronged approach to optimize your returns. First, it targets diversified businesses with proven profitability, focusing on sectors less susceptible to market volatility. This is paired with a robust safety net, consisting of asset-backed security and a fixed interest rate. To top it off, the plan includes a unique referral program, giving you the opportunity to boost your earnings. The result is not just an investment, but a tailored financial solution that maximizes your wealth and minimizes risk.

With P7’s Plans, your investment effectively serves as a loan to our established and profitable business portfolio, ensuring stable and predictable returns.

This method offers secure, bond-like advantages with a promise of fixed earnings.

Enjoy a stable and consistent 8.1% annual interest rate with the Pulse Plan. This one-year investment is designed to provide predictable growth and secure returns.

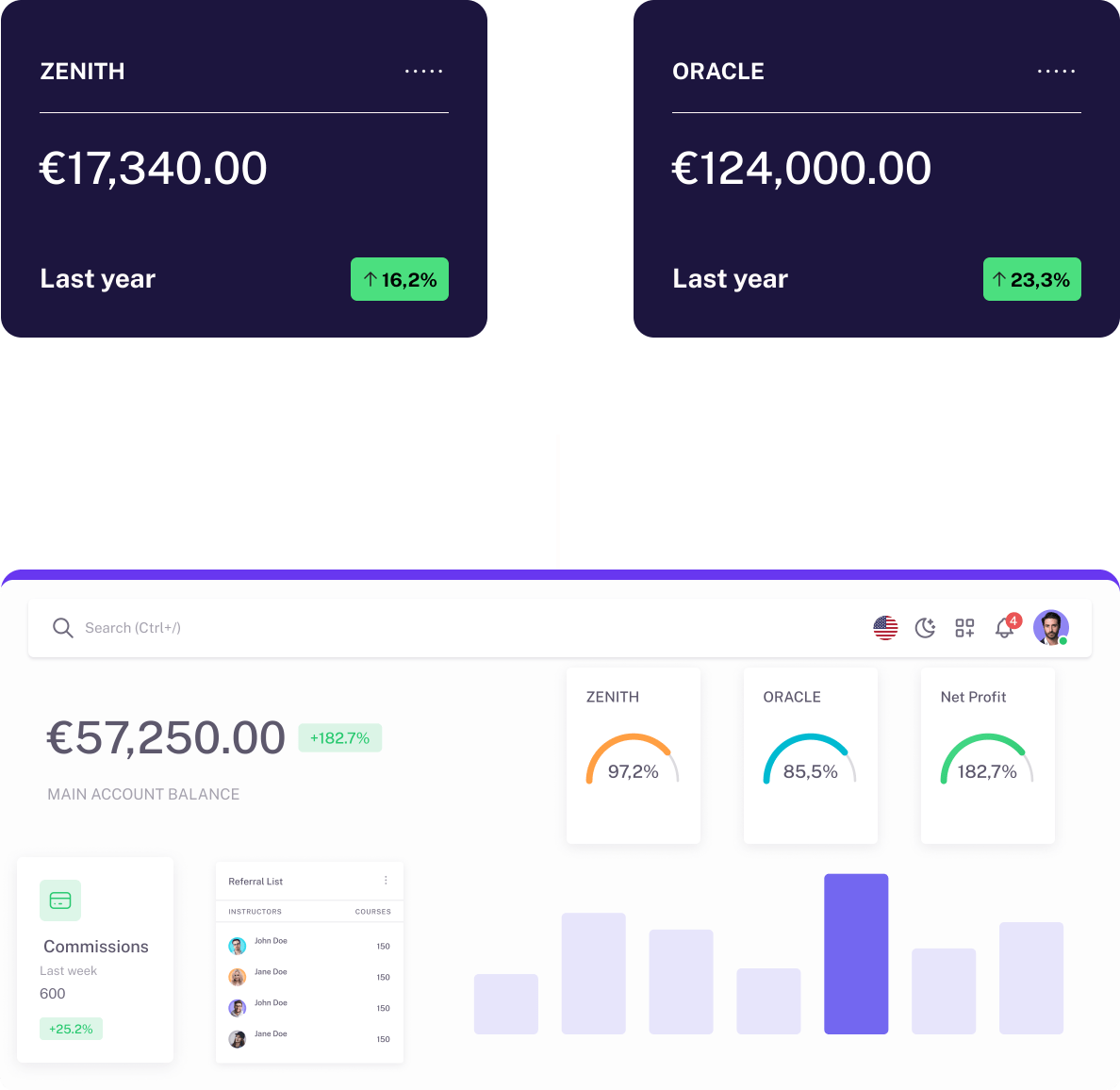

Pulse investments are grounded in existing, profitable operations within retail, e-commerce, and professional services, enhancing the safety of your funds.

By avoiding the inherent risks of new ventures, your investment is shored up by enterprises with a history of success and fiscal responsibility.

This targeted approach ensures that your funds are not only backed by tangible assets but are also reinvested into operations with a track record of profitable growth, offering a stronger safeguard for your investment

Pulse integrates strong force majeure measures, safeguarding your investment against unexpected market changes, ensuring the stability of your returns.

Asset Safeguard: Investments in the Pulse plan are backed by a robust portfolio of EU-based tangible assets, offering an additional layer of financial security.

Strategic Diversification: The plan’s assets are strategically diversified within stable and profitable EU sectors, enhancing resilience against unforeseen global events.

Investor Assurance: In extreme scenarios, the plan is structured to prioritize investor capital preservation, with the option to liquidate or allocate equivalent assets to investors, ensuring capital is not forfeited.

Funds in Pulse are meticulously allocated to solid, existing businesses in retail and professional services, offering robust collaterals for added investment security.

Turn your network into your net worth.

When you introduce a new investor to the Pulse plan, each of you will benefit from a €150 bonus, enhancing your investment journey

The bonus is immediately available to the new investor, while you, as the referrer, will see your reward once their investment is active

This reciprocal incentive fosters a community of growth, where sharing the opportunity expands rewards for all involved.

The Pulse Plan’s structure is fully securitization-eligible.

Asset-backed loan positions can be pooled and transformed into tradable securities, enabling professional investors to create customized ABS or CDOs for enhanced portfolio flexibility.

This mechanism increases liquidity, reduces risk concentration, and supports strategic capital deployment across multiple asset classes. The result: institutional-level control over asset cycling, yield optimization, and exit timing—without compromising on underlying collateral integrity.

Step into a world of investment where transparency reigns supreme.

With Zenith, you’re assured of a fee structure that’s straightforward—no management fees, no processing fees, and absolutely no hidden costs.

Our commitment to transparent financial commitments ensures that your investment experience is crystal clear, with no unexpected charges.