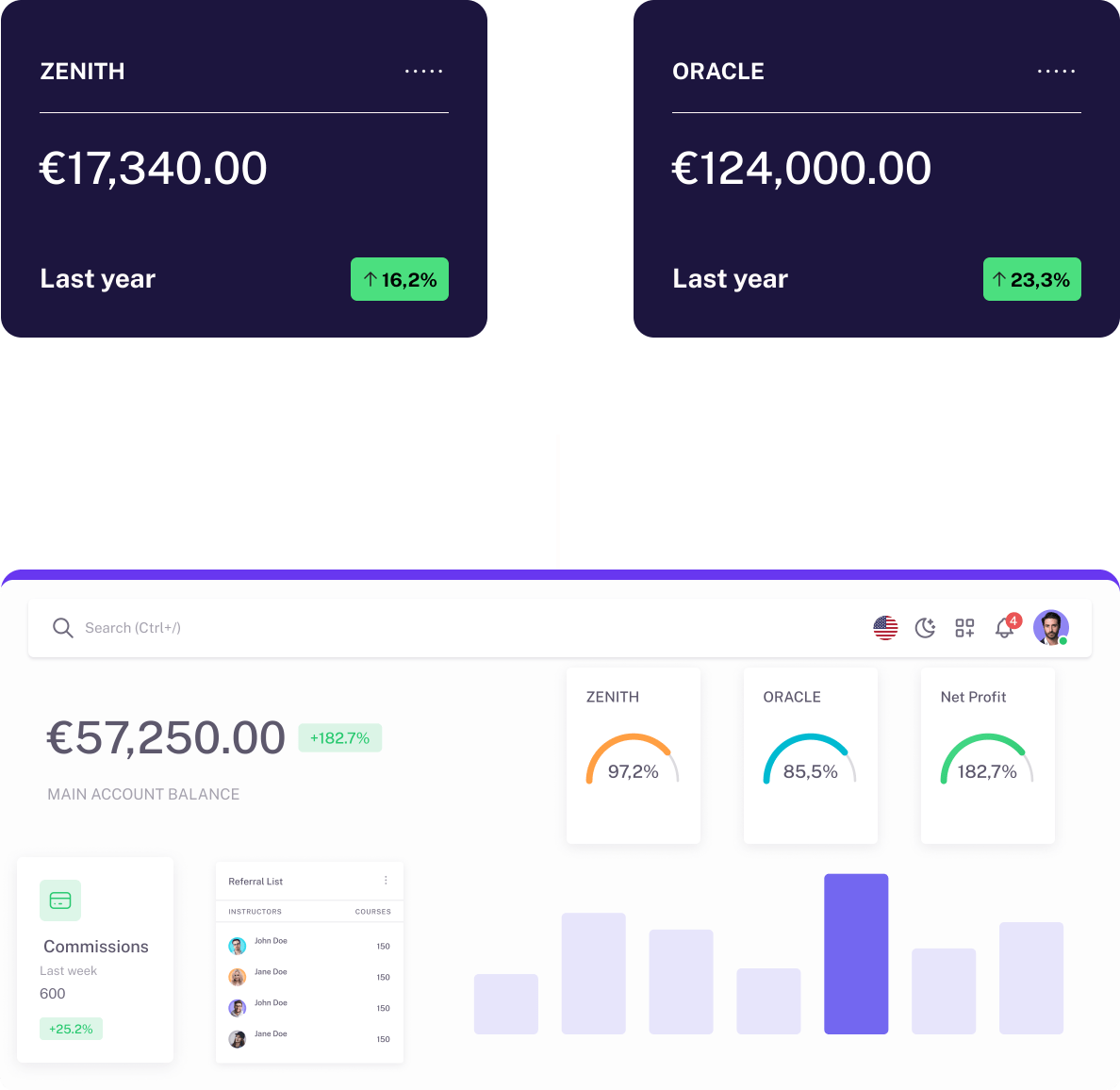

P7 Oracle

Building upon the solid foundation established by the Zenith Plan, the Oracle Plan represents the pinnacle of P7’s investment offerings for the visionary investor. With a five-year horizon, Oracle is the epitome of foresight and strategic financial planning, offering an attractive annual interest rate that commences at 17.1% and has the potential to ascend to 23.3%

Oracle is tailored for the astute investor who not only seeks the assurance of steady returns but also values the opportunity to augment their earnings through a series of performance-based bonuses. This plan is a testament to the power of compounded growth and the rewards of loyalty, designed for those who take a long-term view of their investment journey, forging a path towards substantial wealth accumulation.

Mission

The Oracle Plan is a testament to foresight in investment, offering a robust strategy for those who prioritize long-term financial growth. It rewards investors with a competitive interest rate over a five-year horizon, accompanied by a series of bonuses that enhance returns for those who demonstrate commitment and long-term engagement.

Investing in Oracle means strategically allocating your funds in a diversified portfolio. Investments are directed towards business operations across the EU and US markets and securing tangible assets that hold intrinsic value. The Oracle Plan is designed not just as an investment but as a sanctuary for your financial aspirations.

In essence, the Oracle Plan is more than just an investment option — it’s a commitment to a long-term partnership. Every step taken is designed to solidify your financial future, with P7 as a reliable guide towards achieving your financial aspirations.

Solution

Within the framework of the Oracle Plan, investors are not just contributing capital; they are engaging in a strategic financial maneuver. This five-year plan is a commitment to growth, wherein every element is fine-tuned for financial success. From the selection of high-margin EU and US business ventures to the acquisition of assets with lasting value, every step is calculated for maximum financial impact.

The Oracle Plan affords investors the benefit of compounded growth, with an attractive base interest rate and additional bonuses for reinvestment and long-term commitment. It offers an innovative tiered bonus system to maximize investor returns: a 1% Commitment Bonus for foresight, a 0.5% Longevity Bonus as a nod to perseverance, and a 2% Cumulative Loyalty Bonus that crowns continued trust.

Moreover, the plan extends beyond mere numbers, ensuring full force majeure protection and an investment in assets that resonate with value and stability. It’s not only about growing wealth but also about providing a cushion against economic shifts, with investments in real assets that stand the test of time. The Oracle Plan is P7’s pledge to nurture your financial growth, ensuring each investor’s portfolio is robust enough to weather any storm.

Your Oracle Journey

Embark on a strategic path with the Oracle Plan, where every step in your investment process is guided by our commitment to security, growth, and adaptability.

Here, we detail your journey from initial engagement to successful investment realization, showcasing the clarity and precision of the Oracle experience.

Get, Set, Ready

No hidden fees

Sign the Agreement

Upon selecting your preferred term and bonus options, you’ll be presented with a detailed investment agreement.

This agreement encompasses all aspects of your investment in the Oracle plan, including the term length, interest rates, bonus structures, and any specific terms related to your investment.

Signing this document solidifies your commitment and sets the stage for your investment journey with P7. It’s not just a formality but a key step in securing your financial future with a clear understanding of the benefits and responsibilities involved in the Oracle plan.

The Oracle Plan pledges a solid interest rate for a five-year term, ensuring your financial growth is not left to chance. This assurance of returns is backed by the meticulous selection of investment ventures, each chosen for their proven track record and enduring value.

Investments are strategically placed in high-value sectors, underpinned by assets designed to withstand economic variances. By treating your investment as a loan to these ventures, P7 creates a predictable stream of earnings, replicable to the security of bonds but with the potential for greater yield.

The Oracle Plan directs investments into high-value ventures, ensuring a solid foundation for returns. Investments focus on sectors like hospitality, property, and leisure assets, providing consistent growth over five years.

Your investment functions similarly to a loan, offering predictable, fixed returns with the stability of bonds. This asset-backed approach safeguards the plan’s growth potential. With a definitive return profile, bolstered by tangible assets, the Oracle Plan offers secure financial progress, insulated from unpredictable market trends.

• Asset-Backed Certainty: Our commitment extends to ensuring that your investment is always backed by real-world assets with intrinsic value, which stand ready as a bulwark to protect your interests in times of market turbulence.

Through this comprehensive protection framework, we guarantee that your investment with the Oracle Plan is built to endure, offering you not just returns, but resilience.

Investments in the Oracle Plan are anchored in tangible assets across selected sectors, each providing a solid and physical collateral base. This strategic diversification not only secures your investment but also leverages physical assets for stability and potential growth:

- Real Estate Development and Management: Investments are grounded in physical real estate properties. From commercial developments to residential projects, these real assets offer a reliable collateral foundation and potential for appreciation.

- Luxury Retail: This sector focuses on tangible luxury items, from high-end fashion to exclusive products. These physical assets provide a dependable collateral base, ensuring investment security even in volatile markets.

- Maritime Services: Investments here include physical maritime assets like boats and yachts, essential for global maritime operations. These assets offer long-term value and stability, underpinning your investment with solid collateral.

- Banking Services: Concentrating on tangible banking assets and fintech initiatives, this sector provides a firm collateral base through its integral role in the financial sector and its potential for lucrative returns.

By investing in these sectors, the Oracle Plan assures that your capital is backed by real-world, high-value assets, reinforcing the promise of secure and growth-oriented returns.

The Oracle Plan offers a transformative reinvestment opportunity that significantly amplifies your earnings over the course of five years. By reinvesting your initial capital and the interest gained at each cycle, you unlock an additional 0.9% increase in your interest rate with every reinvestment.

Longevity bonus rewards investors who maintain their investment over an extended period. It becomes applicable starting from your second consecutive investment term, enhancing the interest rate as a token of gratitude for your ongoing commitment to P7

Starting your journey with the Oracle Plan by committing to at least two consecutive five-year terms from the beginning is rewarded with a 1% Commitment Bonus, giving your returns a significant uplift.

With the transition into a third five-year term, a 2% Cumulative Loyalty Bonus further augments your rate, recognizing and rewarding your extended partnership with P7, to foster greater growth of your investment over time

The Oracle Plan’s structure is fully securitization-eligible.

Asset-backed loan positions can be pooled and transformed into tradable securities, enabling professional investors to create customized ABS or CDOs for enhanced portfolio flexibility.

This mechanism increases liquidity, reduces risk concentration, and supports strategic capital deployment across multiple asset classes. The result: institutional-level control over asset cycling, yield optimization, and exit timing—without compromising on underlying collateral integrity.

Step into a world of investment where transparency reigns supreme.

With Oracle, you’re assured of a fee structure that’s straightforward—no management fees, no processing fees, and no hidden costs.

Our commitment to transparent financial commitments ensures that your investment experience is crystal clear, with no unexpected charges.