P7 Forefront

Through advanced risk management practices, state-of-the-art cybersecurity measures, and a commitment to asset-backed stability, we go beyond the basics to offer a deeper understanding of how your capital is optimized for growth. Begin your journey with us, where each investment is not just a transaction, but a step towards realizing your long-term financial vision with precision and trust.

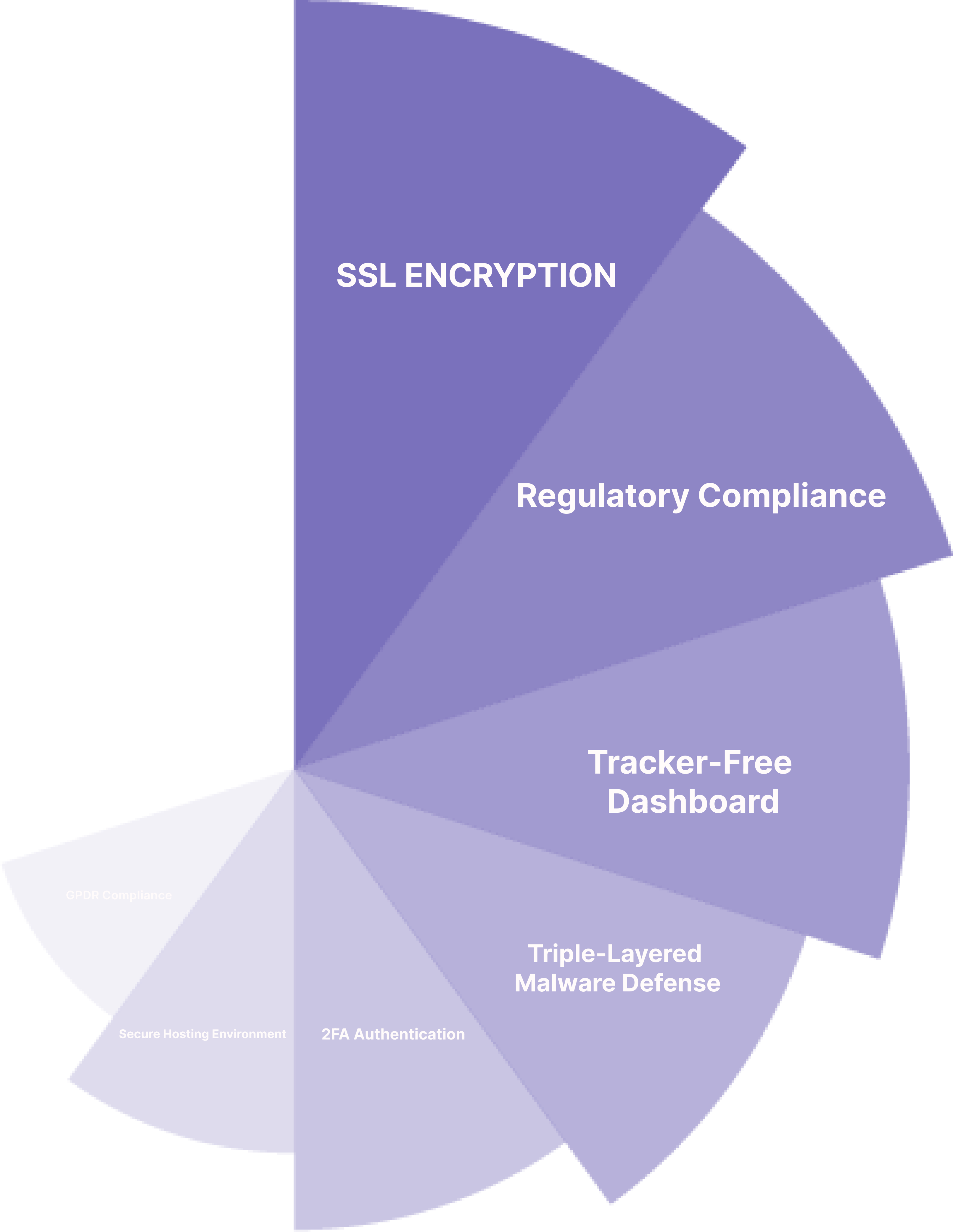

360° SECURITY

Your Security, Our Priority. At P7, safeguarding your investments and personal information is not just a commitment—it’s the foundation of how we operate. Dive into the multi-layered security measures we employ, from robust web protocols to our comprehensive financial contingency plans, designed to ensure your peace of mind at every step of your investment journey.

Data protection

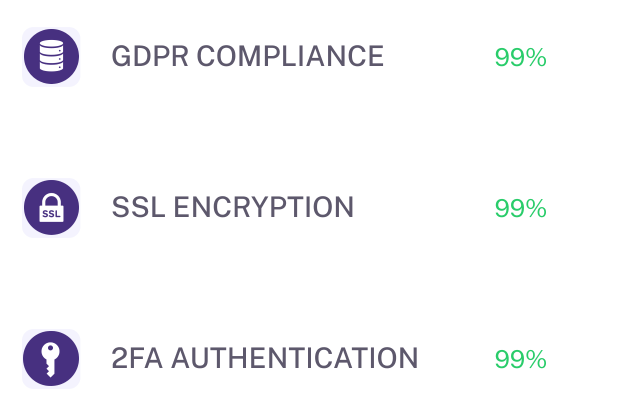

Experience transactional integrity on P7’s state-of-the-art, fortified platform. Our manual wire transfer protocol ensures transactional exclusivity, allowing only the verified bank account holder to initiate fund transfers. Benefit from SSL encryption and multi-factor authentication, all hosted on a secure VPS. Data is backed up every 30 days and exported to an offline drive bi-monthly to maintain data integrity.

Additionally, P7’s platform undergoes non-stop, 24/7 scanning for malware, vulnerabilities, and other online threats to ensure uninterrupted, robust protection of your financial activities. P7’s cutting-edge technology is dedicated to safeguarding your financial security.

- Top-Tier Encryption

- Regulatory Compliance

- Tracker-Free Dashboard

- Triple-Layered Malware Defense

PINESEVEN IS COMPLIANT WITH CCPA/CPRA, GDPR, SOC2 TYPE II, ISO 27001, U.S. ESIGN Act of 2000, eIDAS AND WCAG ACCESSIBILITY GUIDELINES. ALL PINESEVEN’S SUBPROCESSORS ARE COMPLIANT AND CERTIFIED TO THESE STANDARDS.

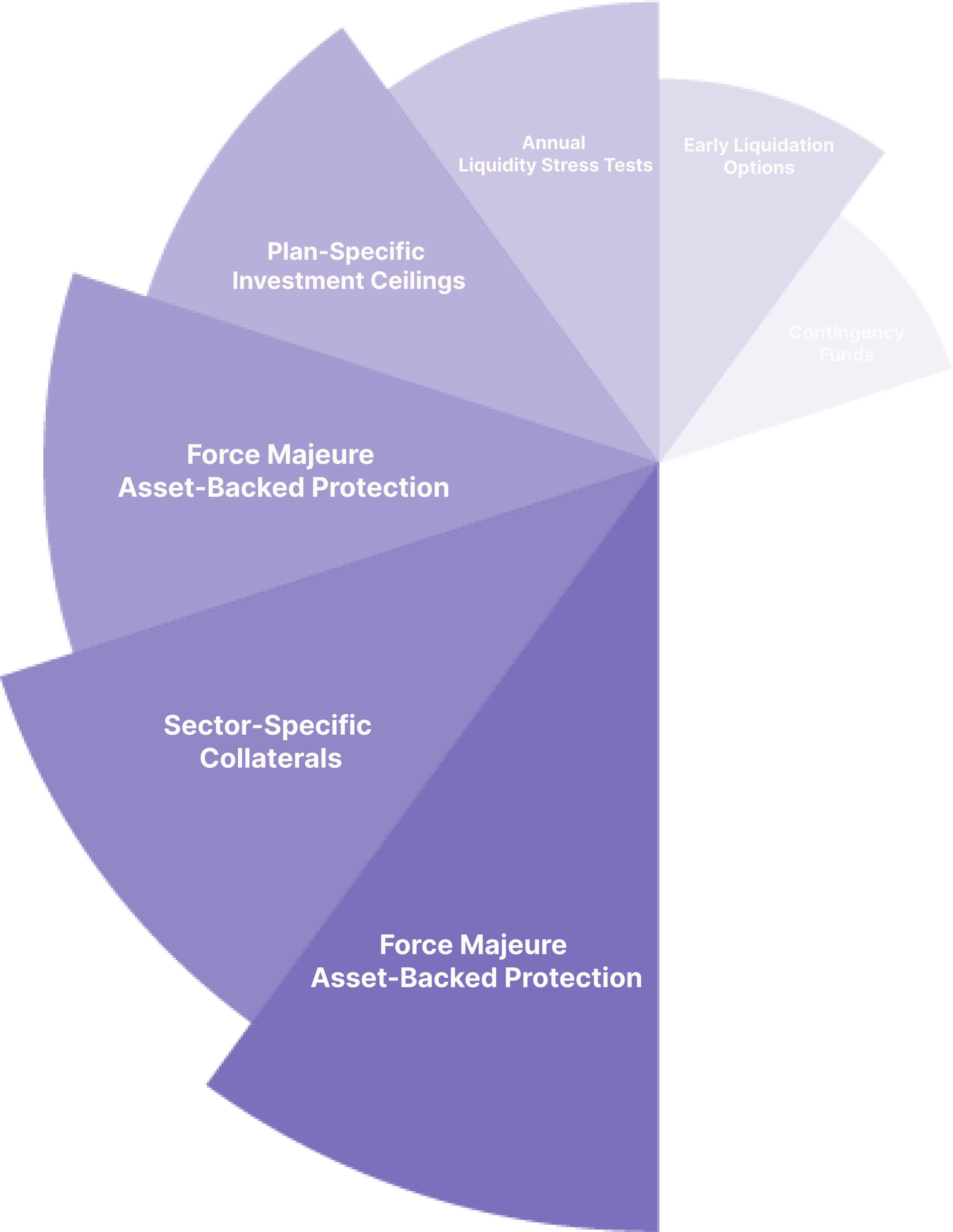

Engineered Financial Stability

P7’s financial model is built on asset-backed guarantees and a diversified business portfolio. We employ due diligence and contingency plans to ensure reliable returns and capital preservation. Your investments are not just managed; they’re engineered for stability and growth.

- Plan-Specific Investment Ceiling

- Annual Liquidity Stress Tests

- Contingency Funds

- Force Majeure Asset-Backed Protection

- EU-Located Assets

- Early Liquidation Options

Insights

Navigate the complexities of investment with ease. P7’s unique model offers more than just investment opportunities—it provides a pathway to financial growth with minimal risks.

Conceptual Framework

The P7 offers high returns by directing capital into diversified, tangible EU based business ventures, not just market trades. It’s not just about numbers on a screen; it’s about generating genuine, sustainable growth

Loan-Based Investment Structure

All investments made through P7 are classified as secured loans. This establishes an additional layer of protection for the investor by insulating returns from market uncertainties

Asset-Backed Security

Investements are protected by a legal structure allowing conversion into equity or tangible assets, such as equipment or real estate. Providing your capital with tangible fallback options for preservation and liquidity

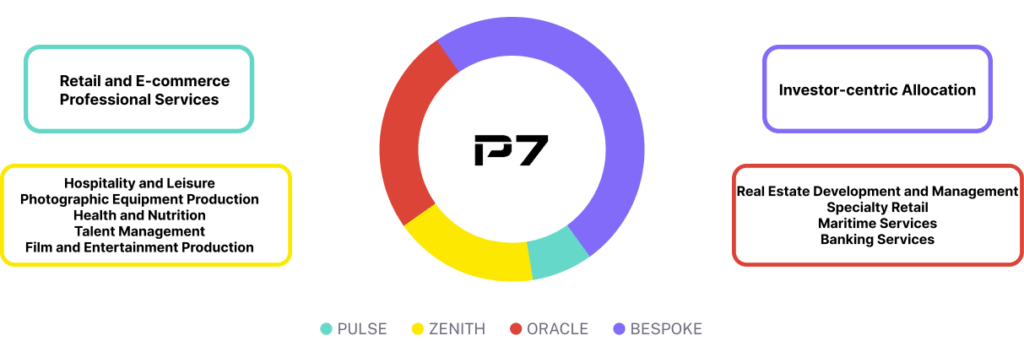

Diversification Strategy

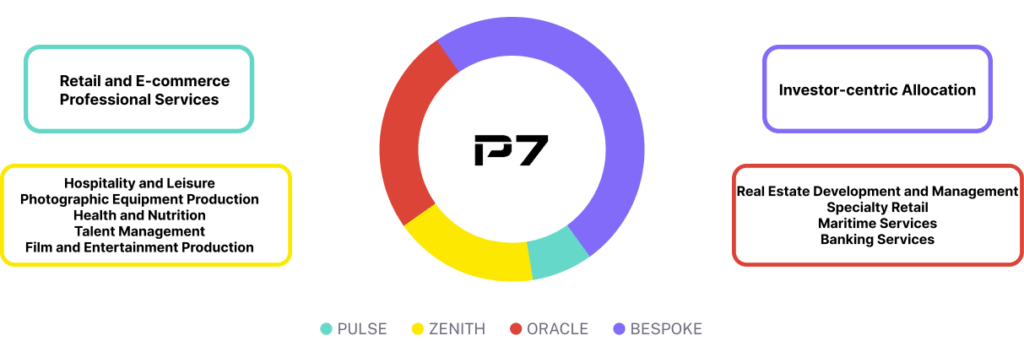

P7’s model is designed to span multiple sectors avoiding overlap. This diversification enhances the potential for high returns and minimizes the sector-specific risks, providing you with the safest investment environment

Believe in an open world

The world is richer when money has no borders.

Your engagement fuels dynamic genuine businesses, creating jobs and fostering economic vitality, converting individual rewards into mutual advancement.

Get, Set, Ready

No hidden fees

Maximize Earnings During Investment Term

While your investment matures, be proactive and amplify your returns with our rewarding referral program, you can earn substantial bonuses by introducing new investors to P7.

By upgrading to a P7 partnership status, you unlock the gateway to even more earnings through elevated referral limits and exclusive premium bonuses.

It’s a continuous cycle of growth, perfectly complementing your primary investment.

Frequently asked questions

Cryptocurrencies are highly volatile and can fluctuate wildly in value. P7’s structure includes stringent due diligence and compliance checks. Cryptocurrencies, while legitimate investments, have been tarnished by numerous scams and fraudulent schemes, often due to less transparent environments.

– Returns: P7’s returns are fixed and can be enhanced by long-term commitment bonuses. Cryptocurrency investments are speculative and can potentially offer high returns, but they come with a significant risk of loss.

– Tangibility: P7 investments are backed by real assets, which can be liquidated or transferred to investors in critical scenarios. Cryptocurrency’s value is digital and can be rendered worthless if the market collapses or if a particular currency fails.

High-level hedge funds typically cater to accredited investors — individuals with a high net worth or significant annual income. This restricts access to those who meet strict financial criteria. Hedge funds usually require a substantial initial investment, often millions of dollars, which further limits their accessibility. In addition to entry barriers, hedge funds charge management fees (around 2% of assets under management) and performance fees (often 20% of the profits), which can significantly diminish the actual returns for investors.

P7’s asset-backed investments are crafted to broaden access to wealth-building opportunities, offering a lower minimum investment entry point suitable for a diverse investor base. P7 plans deliver fixed and predictable returns, free from management and performance fees, guaranteeing that the returns presented are precisely the returns investors will receive

The asset-backed approach of P7 also instills a level of confidence in the security of the investments, with the added benefit of higher potential yields supported by the performance of a diversified portfolio. Additionally, P7 rewards long-term investor commitment with bonuses that compound over time, enhancing the total investment return without the fee erosion commonly associated with hedge funds.

Historically, after adjusting for management fees and performance bonuses, the actual annual returns of hedge funds have often been disappointingly low. This stands in sharp relief to Warren Buffett’s famous bet which highlighted that over a ten-year period, hedge funds underperformed compared to a simple S&P index fund, with some reports indicating actual realized returns for investors in hedge funds averaging below 3% per annum.

P7’s investment structure, free from burdensome fees, aims to ensure that the returns promised are the returns delivered, positioning it as a more efficient alternative to the traditional hedge fund model.

P7’s asset-backed structure differs from insured bonds in several ways.

Insured bonds are debt securities guaranteed by a third party, typically an insurance company, to mitigate the risk of default.

In contrast, P7’s investments are secured by tangible assets such as real estate, yachts, and business ventures.

This means that in the unlikely event of a financial downturn, your investment is backed by real-world assets that have intrinsic value, providing an additional layer of security.

Additionally, insured bonds typically offer fixed returns, often not surpassing 5% annually.

On the other hand, P7’s asset-backed investments provide a more dynamic earning potential, with plans offering returns ranging from 8.1% to 23.3%.

This marked difference in yield is a result of the performance of P7’s diversified portfolio, coupled with exclusive bonuses for long-term commitment and reinvestment, positioning P7 as a more lucrative option for investors seeking higher returns without compromising on security.

Investing in P7’s asset-backed plans offers several advantages over traditional registered fixed income instruments.

Registered fixed income instruments are debt securities with returns based on a fixed interest rate over a predetermined period. They carry a risk of default; if the issuer – be it a corporation or a government – encounters financial difficulties, the recovery for investors depends on the issuer’s ability to pay. In the event of bankruptcy, investors might not recover their investment. P7’s asset-backed investments, on the other hand, are secured by tangible assets.

These assets act as collateral, meaning that in the event of a default, the assets can be liquidated to repay investors. This security structure aims to provide an additional layer of protection against the loss of capital.

Asset-backed structure offers a more secure position compared to fixed income instruments.

P7’s approach is designed to mitigate the risk to investors’ capital, contrasting with the inherent risks found in traditional fixed income products that lack collateral.

A plan ceiling is the total cap on funds that can be allocated to a specific investment plan within P7. This is not an individual investment limit, but rather the aggregate maximum that can be invested by all participants in the plan.

Once the ceiling is reached, P7 will temporarily stop accepting new investments into that plan until existing commitments are fulfilled and paid out.

This limit is established to ensure diversification of investments and to manage risk effectively. It also helps in maintaining the quality and performance of the investment by not over-leveraging any single plan.

Each plan has its own ceiling, which is determined by P7’s strategic asset allocation model and risk management framework.

1. Commitment Bonus (Zenith and Oracle Plans): This bonus is for investors who commit to at least two terms in advance. It’s an additional return percentage, incentivizing a longer-term investment commitment. This bonus applies to both the Zenith and Oracle plans.

2. Longevity Bonus (Oracle Plan): Exclusive to the Oracle plan, this bonus rewards investors who maintain their investment over an extended period. It’s our appreciation for your long-term engagement and trust in P7.

3. Reinvestment Bonus (Zenith and Oracle Plans): When you choose to reinvest your returns in the Zenith or Oracle plan, you qualify for this bonus. It’s added to the reinvested amount, enhancing your overall investment growth.

4. Cumulative Loyalty Bonus (Oracle Plan): A unique feature of the Oracle plan, this bonus is automatically added at the end of the second term and increases incrementally for each subsequent term. It signifies our gratitude for your continuous investment with us.

P7 accommodates investments made through various legal structures, including trusts and corporate entities.

Investors must provide the necessary documentation during the vetting process to ensure compliance with anti-money laundering regulations and P7’s internal policies.

While P7 is working towards establishing a banking division that will offer loans, currently, loan services are not available through the P7 platform.

We will keep our investors updated on the progress and availability of new services as we expand.

P7 offers the flexibility to allocate funds across different plans at the same time.

This enables investors to tailor their investment strategies across various terms and interest structures, optimizing their financial outcomes according to individual preferences and financial goals.

Investments are typically locked in for the duration of the plan’s term. After the term ends, investors have the option to switch to a different plan that suits their evolving financial goals.

P7 aims to provide flexibility and will assist investors in making a smooth transition to their new chosen plan.

P7 operates on a real-time platform, providing investors with immediate updates reflecting the current status of their investments.

For Zenith and Oracle plans, up to three auto-reinvestments are available, offering investors the convenience of automatically rolling over their capital and accrued interest into a new term.

The Pulse Plan allows for a single auto-reinvestment.

However, for Zenith and Oracle plans, it is advisable to consider an initial commitment to 2-3 terms from the outset to be eligible for a 1% Commitment Bonus, enhancing the overall return on the investment.

Our portfolio is composed of fully-owned entities that are central to P7’s business strategy.

Access to partial or full disclosure of our portfolio is reserved for investors engaged in our Oracle and Bespoke plans.

This selective transparency is key to maintaining strategic discretion while protecting against a spectrum of adversarial actions, thereby ensuring the security of our operations and our investors’ interests.

For our three principal plans, we do not accept investments made through cryptocurrency.

P7 maintains a policy of transacting exclusively in fiat currency to align with our asset-backed investment structure.

However, for bespoke investment plans tailored to individual requirements, P7 may consider accepting a partial investment made through cryptocurrency on a case-by-case basis. This is subject to a thorough due diligence process to ensure compliance with all applicable financial regulations and the security of the investment.

No, payouts from P7 investments are strictly processed through traditional banking channels to ensure security and compliance with financial regulations.

P7 does not support payouts to cryptocurrency wallets, as this does not align with our asset-backed investment structure and commitment to stability and regulatory adherence. All transactions are conducted in fiat currency to maintain transparency and security for our investors.

Yes, you can transfer the balance from your P7 account to another user’s account on the platform at any time.

However, if you wish to sell or gift your stake in an active investment plan, this requires prior notification to P7. We will facilitate the process by informing potential buyers among the current investors to expedite the transfer.

Absolutely not. P7 will never request access to your credit card or bank account.

All transactions are conducted securely via bank transfers, initiated by you, the investor. This policy ensures the highest level of security and autonomy for our clients, guaranteeing that no transfers are made without your explicit consent and action.

Choose the right solution

Select from tailored investment options that align with your financial goals. Each plan with P7 offers a unique blend of security and growth potential.

PULSE

One-year plan with investment range from €1.5K to €5K. Ideal for short-term growth.

8,1%

/ yr.

- 8,1% Flat Rate Interest

- €50 Sign-up Bonus

- €90 Referral Bonus

- One-Time Reinvest

- Rapid Capital Turnover

- 125K Plan Ceiling

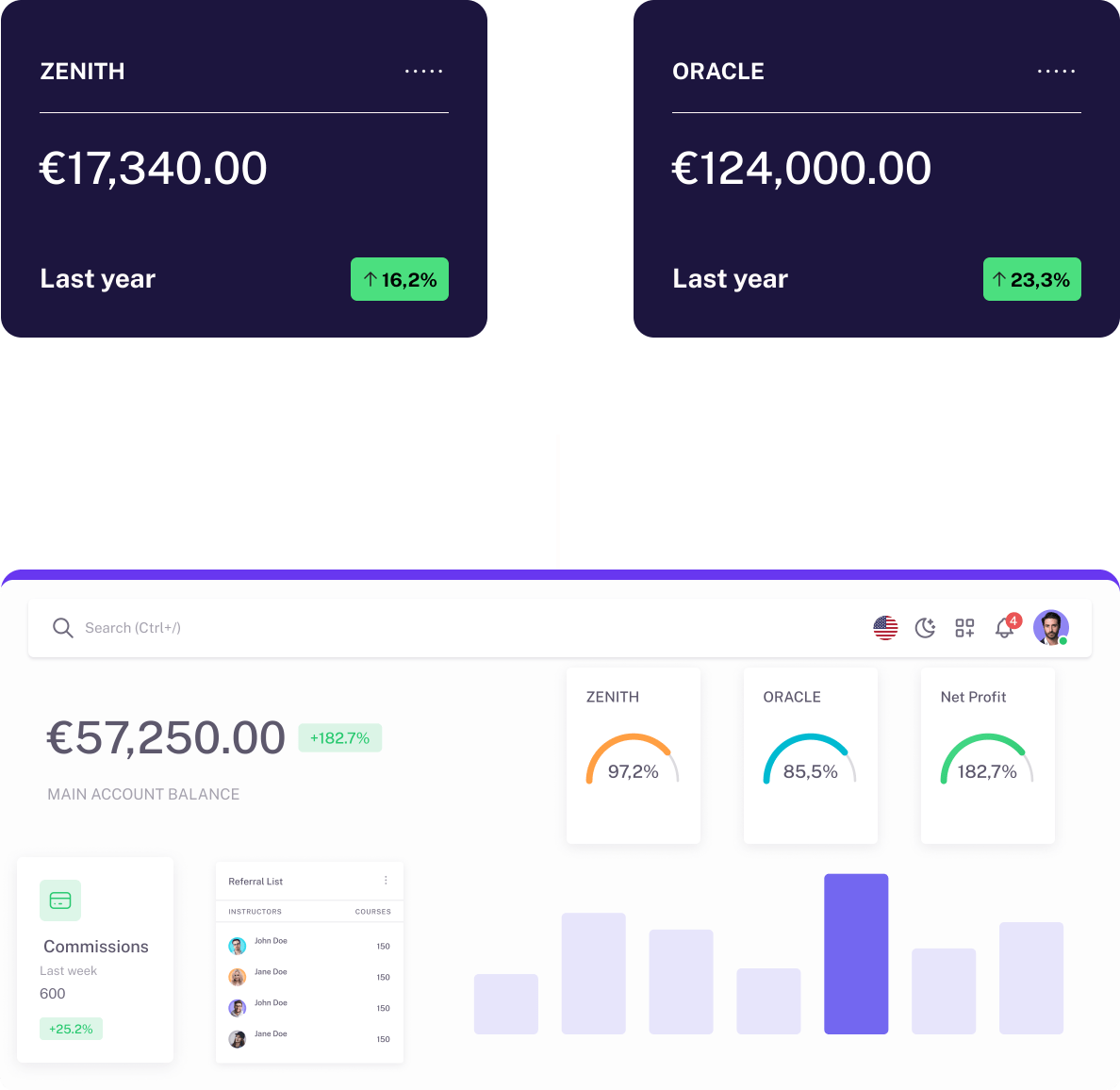

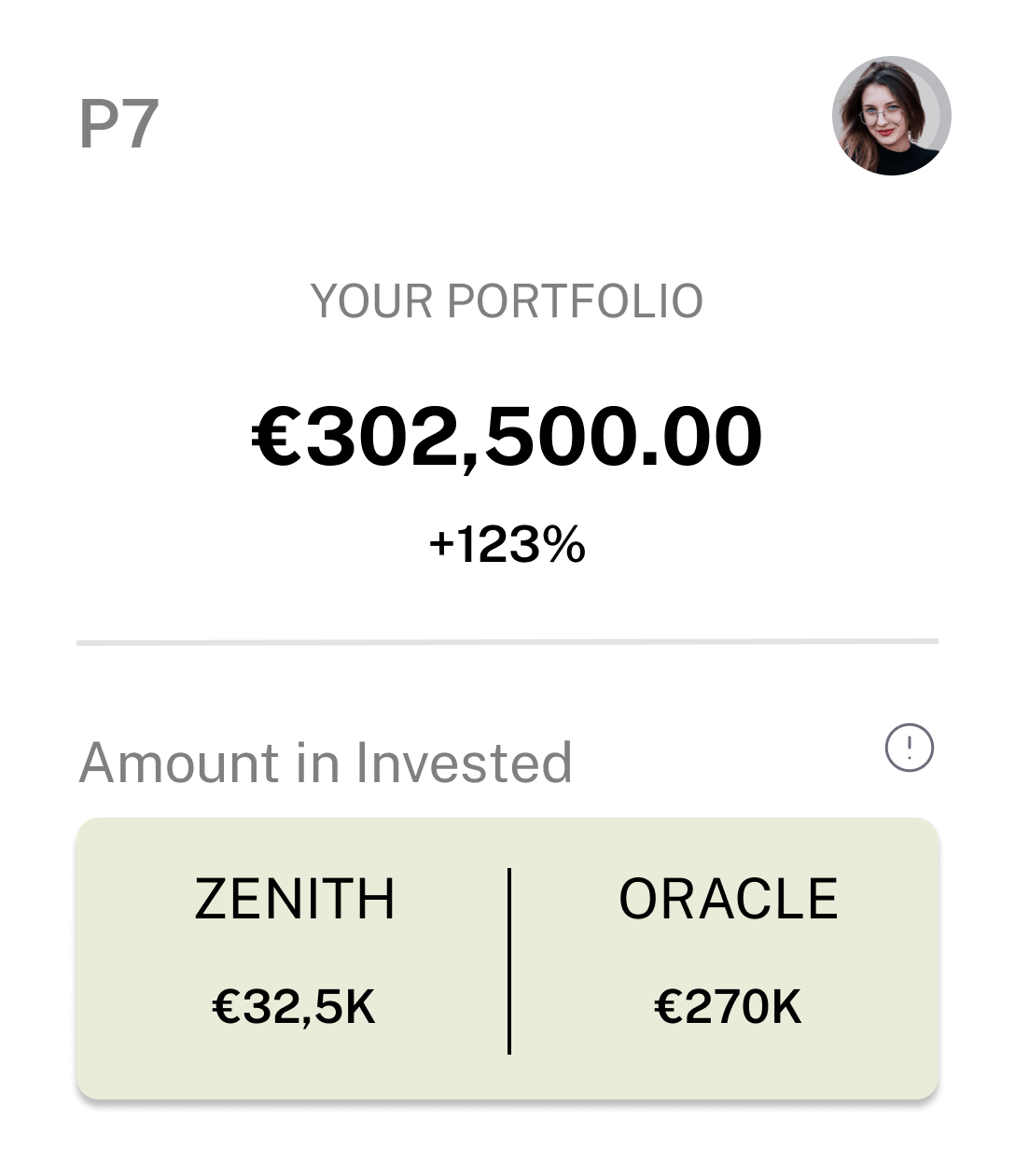

ZENITH

Three-year commitment with options from €10K to €70K. Balancing longevity and returns.

12,5-16,2%

/ yr.

- 37.5% Base / 3 Yrs

- €150 Referral Bonus

- 0,9% Reinvestment Bonus

- 1% Commitment Bonus

- Three Reinvests Max

- 2,3M Plan Ceiling

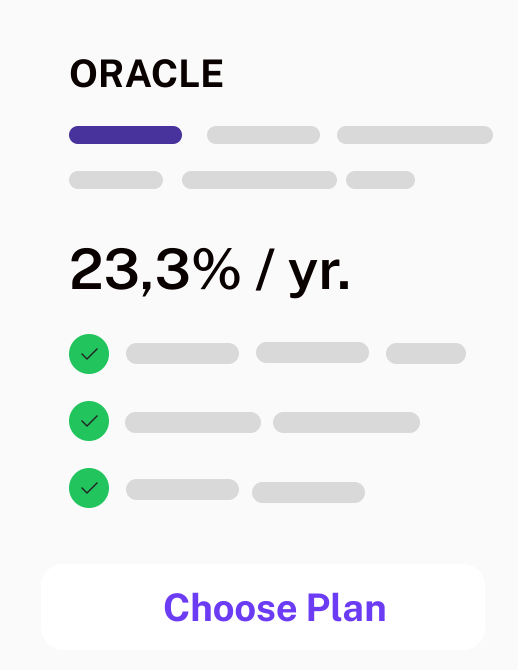

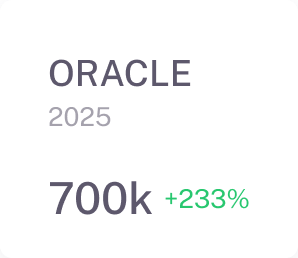

ORACLE

Top Rated

Five-year horizon, investing €100K to €800K. For profound, long-term financial expansion.

17,1-23,3%

/ yr.

- 85.5% Base / 5 Yrs

- 1% Commitment Bonus

- 0,5% Longevity Bonus

- 0,9% Reinvestment Bonus

- 2% Cumulative Loyalty Bonus

- 10M Plan Ceiling

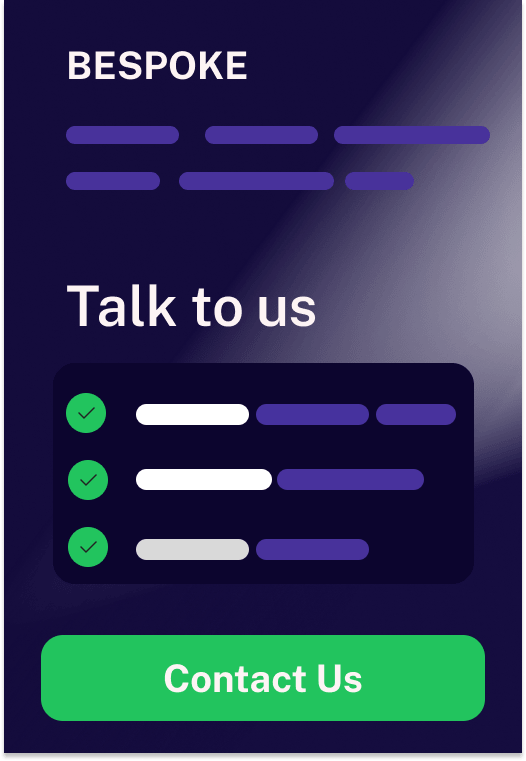

Need a Custom Plan? Ask About Bespoke.

An investment pathway tailored to meet your unique financial goals and preferences. This exclusive offering is designed for individuals or entities planning to invest ≥ €1.5M, providing a bespoke approach to asset growth and diversification.

- Tailored Investment Structure

- Asset Selection

- Liquidity Preferences

- Priority Support

- Enhanced Control